Know Your Investor (June Edition): Google Ventures

Shots:

- Google Ventures is an investment arm of Alphabet Inc. That invests profusely in seed-stage companies ranging from software and internet to healthcare, life sciences, and artificial intelligence among others

- Ever since 2016, GV pivoted to focusing on established companies. The company manages assets worth $10B and 400 active portfolio companies spanning across North America and Europe

- For a curated report on a specific investor or venture capital, reach out to us at connect@pharmashots.com

Google Ventures

Founded in 2009 by Bill Maris, Google Ventures (GV) is an integral part of the renowned Alphabet. Its headquarters is in San Francisco (US), while its offices are in areas incl. New York, Cambridge, and London. The company made its first investment as a venture capital firm to Silver Spring Networks and Adimab. The operating partners of GV assist companies in the areas of talent, engineering, equity, diversity & inclusion, and design. GV also facilitates companies' interactions with Google.

.png)

GV with a wide portfolio invests in companies like the internet, software, hardware, life science, healthcare, artificial intelligence, transportation, cyber security, and agriculture. GV now manages over $8 billion in assets, with 400 active portfolios and companies across North America and Europe, and its noteworthy investment outcomes include Uber, Nest, Slack, GitLab, Duo Security, Flatiron Health, Verve Therapeutics, and One Medical.

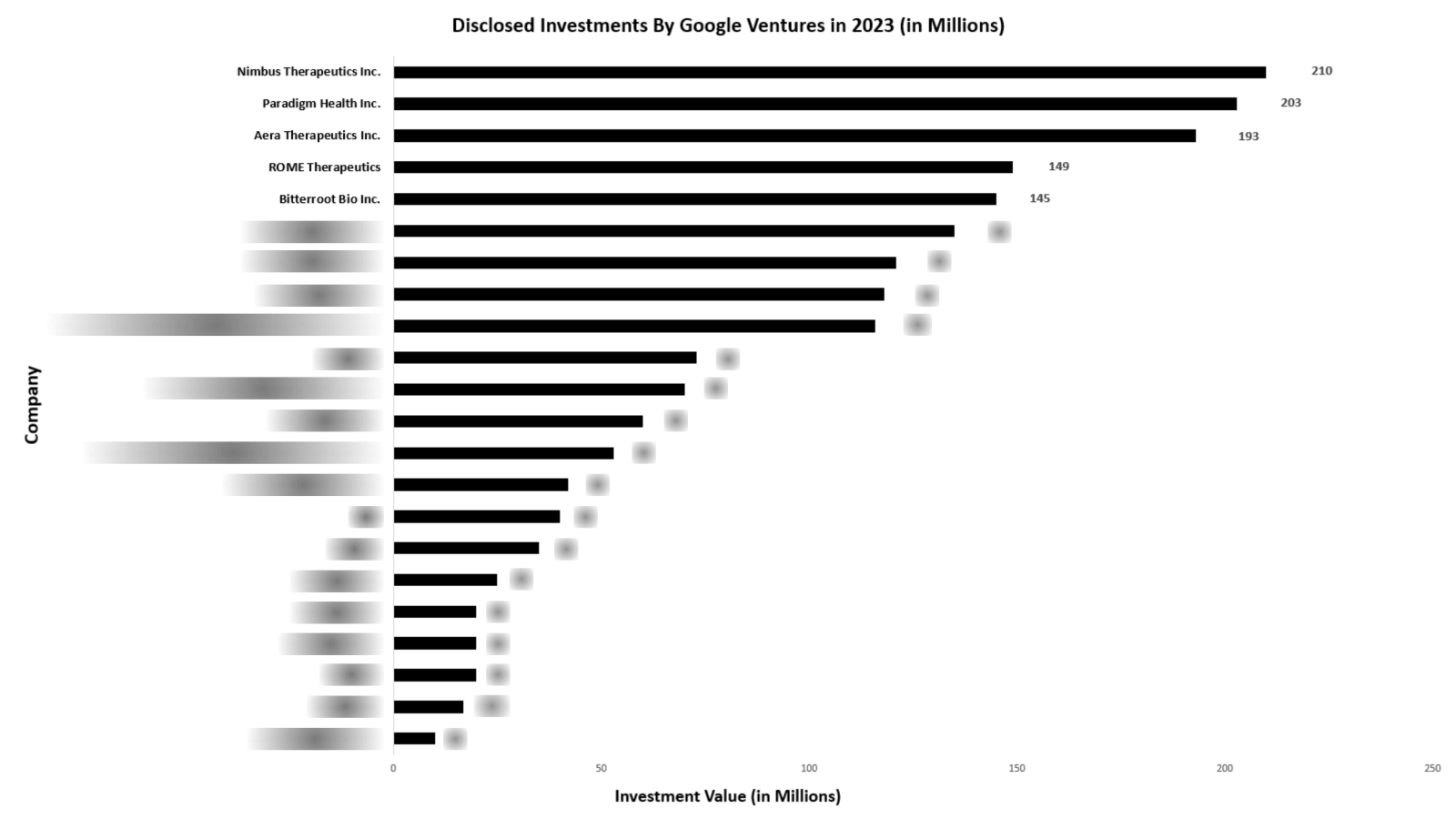

In 2023, GV participated in five investment rounds comprising Seed, Series A, B, C, and E. Gate Bioscience Inc., Tome Biosciences Inc., Accent Therapeutics, Beam Therapeutics, and EpiBiologics are in GV’s investment portfolio. In 2023, Nimbus Therapeutics inc. received the highest funding worth $210M

In 2023, GV closed 23 investments in the healthcare sector, majorly in companies dealing in biopharma, manufacturing, and services. Out of the 23 investments made, 14 were made in biopharma companies. The firm focused on autoimmunity, oncology, genitourinary, infectious diseases, inflammation, neurology, and ophthalmology, among others. GV also made significant investments in technologies, including AI & ML, antibodies, diagnostics, digital health, gene editing/CRISPR, protein-based medicines, DNA-based therapies, small molecules, and so on. Additionally, 43.4% of GV’s total investments in 2023 were made under Series A, whereas 30.4% were made under Series B. The top 3 investments made by Google Ventures are as follows:

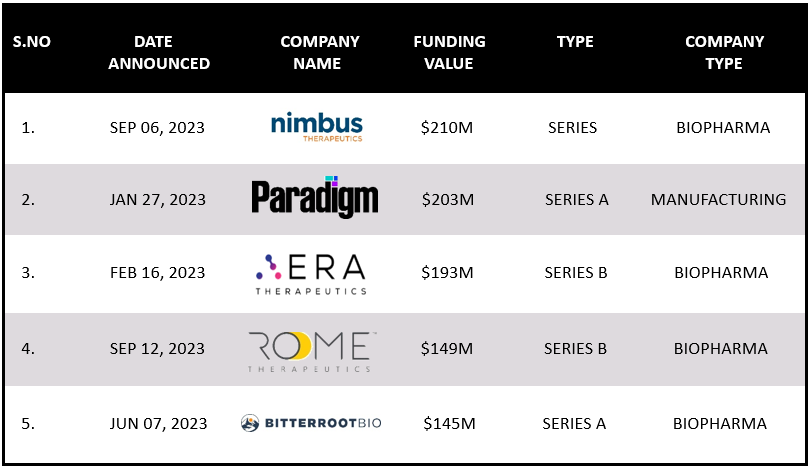

- Unspecified / Private funding worth $210M to Nimbus Therapeutics Inc.

- Series A funding worth $203M to Paradigm Health Inc.

- Series B funding worth $193M to Aera Therapeutics Inc.

In 2023, Google Ventures made

- 10 investments in Q1 2023,

- 4 during the Q2 and Q3 quarters, and

- 5 during the Q4 2023.

A significant share of the 2023 investments was made to Biopharma companies, including Tome Biosciences, Seismic Therapeutic, and Gate Bioscience among others

Google Ventures invested heavily in companies developing therapies associated with small molecules and AI & ML out of which

- Nimbus Therapeutics Inc. received a total of $210M from GV,

- While Seismic Therapeutic Inc. earned $121M,

- Cerevance Ltd. (formerly Takeda Cambridge Neuroscience) received $116M, and

- Antiva Biosciences Inc. (formerly Hera Therapeutics) received $25M.

The following table represents the top 5 funding rounds out of the 23 investments made by Google Ventures in 2023. (For a complete report, reach out to us at connect@pharmashots.com with the subject line "Google Ventures")

Note: (For a complete report, reach out to us at connect@pharmashots.com with the subject line "Google Ventures" or for early access to complete data for future reports and analysis register here: https://forms.office.com/r/VwFu6aUm80)

Related Post: Know Your Investor: Google Ventures

Tags

An avid reader and a dedicated learner, Prince works as a Content Writer at PharmaShots. Prince possesses an exceptional quality of breaking down the barriers of words by simplifying the terms in digestible chunks to make content readable and comprehensible. Prince likes to read books and loves to spend his free time learning and upskilling himself.